Life insurance is not sexy, but did you know that you can use this tool to save and grow money faster than putting it in an interest saving account? Yes, and you will get more excited if we tell you that this money is Tax-FREE.

Here are the main reasons why buying life insurance is a crucial element of sound financial planning.

Life insurance is not sexy, but did you know that you can use this tool to save and grow money faster than putting it in an interest saving account? Yes, and you will get more excited if we tell you that this money is Tax-FREE.

Here are the main reasons why buying life insurance is a crucial element of sound financial planning.

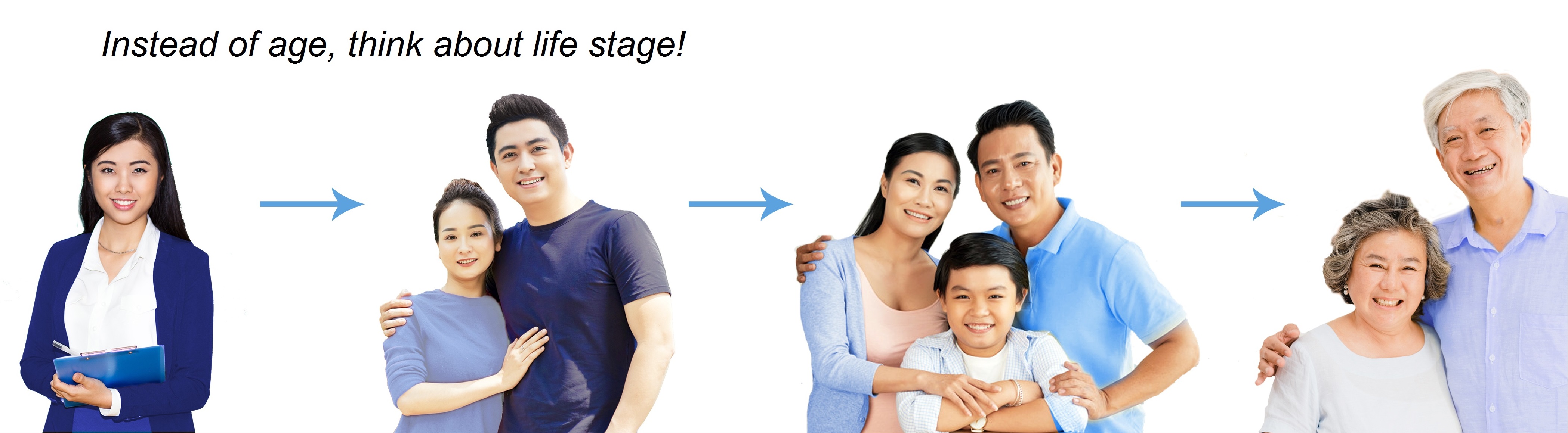

As you grow older, getting married, starting a family, or begin a business, you will realize that life insurance is a must have tool in your financial plan. Life insurance has given a lot of Canadians peace of mind knowing that money would be available quickly to protect their family, avoid probate fees estate and even build an emergency fund for themselves inside the life insurance that is Tax-FREE.

Did you know that whole life insurance can build up cash value inside the policy? Yes, certain life insurance policy can be used as a tax Shelter to grow their money tax free. You can access this money for purchasing your first home or make an investment.

Talk to our AHA Life Insurance Advisor find out how we can help your grow your money passively.

There are two thing in your life that is unavoidable: death and taxes. But wait, you can enjoy the living benefits of life insurance now. Did you know that cash value will be built up inside a whole life insurance? And you can access this money while you are a live. You can use this money as an emergency fund, for investment, and even for early retirement.

According to LIMRA, a worldwide research organization in the insurance and financial industry here are the main reasons why over 68% Canadians own a life Insurance: